FAQ

EDSX FAQs

EDSX is one of the first digital IPO or security token exchange. It allows an issuer to raise capital offering securities on the blockchain and it allows investors to buy these securities on the primary market or on the exchange. Investors can use the exchange of EDSX to resell the securities adding liquidity to their investments.

- be compliant with all the rules and regulations in Switzerland;

- offer a secondary market for securities;

- provide investments from quality issuers with a diversified risk-return profile (not just ICOs and seed projects).

You need to register here. It’s simple and quick.

EDSX is already completely funded. We are not looking for finance.

There is a minimum ticket size that depends on the specific project and no maximum ticket size.

BLOCKCHAIN FAQs

Blockchain is the core technology behind bitcoin. At its heart is a distributed data store. Anyone who participates in this network has their own data store that stores all of the transactions that ever happened on the network (this is also known as the distributed ledger).

Entries are stored within a cryptographic chain of blocks. At every stage, the network of participants must agree about the latest block of transactions. Agreement is reached through a process of majority consensus, eliminating duplicate entries, double spending etc. This process and the cryptographic layering of the blocks makes the agreed blockchain irreversible and immutable. The ‘history’ of events within this technology cannot be modified by any one of the participants without majority consensus from the group.

Ethereum is an open platform that enables developers to build and deploy decentralized applications such as smart contracts and other complex legal and financial applications. You can think of Ethereum as a programmable Bitcoin where developers can use the underlying blockchain to create markets, shared ledgers, digital organizations, and other endless possibilities that need immutable data and agreements, all without the need for a middleman. Released in 2015, Ethereum is the brainchild of the prodigious Vitalik Buterin, who saw the potential uses of Bitcoin’s underlying blockchain technology as the next steps in furthering the expansion of the blockchain community. Ethereum is now currently the cryptocurrency with the second highest coin market cap and is expected by some to surpass Bitcoin as both a valued investment and as the world’s most popular cryptocurrency.

A Smart Contract is code that is deployed to the blockchain. Each smart contract contains code that can have a predefined set of inputs. Smart contracts can also store data. Following the distributed model of the blockchain, smart contracts run on every node in this technology, and each contract’s data is stored in every node. This data can be queried at any time. Smart Contracts can also call other smart contracts, enforce permissions, run workflow logic, perform calculations etc. Smart contract code is executed within a transaction – so the data stored as a result of running the smart contract (i.e. the state) is part of the blockchain’s immutable ledger.

A Security Token Offering (i.e. STO) is the procedure through which the sale of financial instruments to the public is carried out, represented by digital tokens.

The token is a digital tool for the representation of an underlying real asset, i.e. a security (e.g. share, bond, derivative, property, title of property etc.), which entitles the holder to receive future cash flows and it mimics the behavior perfectly.

A company can issue security tokens following the standard procedure for issuing financial instruments to the public, which generally provides (according to different methods from country to country) the publication of a prospectus.

Then, Tokens can be listed on an ad hoc market and sold against traditional currency or/and cryptocurrency.

Nowadays, the major global stock exchanges are creating their own digital platforms for the listing of these instruments: Zurich Stock Exchange (SDX – Swiss Digital Exchange), London Stock Exchange, NASDAQ, Malta Stock Exchange etc. including EDSX.

You can open a secure and free wallet here.

On the Ethereum network you can be fairly certain that your transaction is executed with just one confirmed block. However, it is customary to say that 12 blocks provides almost 100% guarantee. For funds committed directly from the commitment page we provide a link to Etherscan where you can observe the number of confirmations in real time. If you use your own wallet, please refer to its manual for guidance.

FINANCE FAQs

Corporate finance describes financial decisions of corporations; its main objective is to maximize corporate value while reducing financial risk. The financial manager takes responsibility for the corporate finance decisions.

Cash flows refer to the excess of cash revenues over cash outlays, they are usually measured during a specified period of time.

A balance sheet can be analyzed either from a capital-employed perspective or from a solvency-and-liquidity perspective.

The working capital is the net balance of operating uses and sources of funds; if uses of funds exceed sources of funds, the balance is positive and working capital needs to be financed, if negative, it represents a source of funds generated by the operating cycle.

Two main formats of income statement are frequently used, which differ in the way they present revenues and expenses related to the operating and investment cycles. They may be presented either by function or by nature.

The aim of financial analysis is to explain how a company can create value in the medium term (shareholders’ viewpoint) or to determine whether it is solvent (lenders’ standpoint).

Either way, the techniques applied in financial analysis are the same.

Operating profit or EBIT represents the earnings generated by investment and operating cycles for a given period.

Operating leverage links variation in activity (measured by sales) with variations in result (either operating profit or net income). Operating leverage depends on the level and nature of the breakeven point.

Analyzing the credit risk of a company, means to analyze how the company is financed. This can be performed either by looking at several fiscal years, or on the basis of the latest available balance sheet.

We can measure profitability only by studying returns in relation to the invested capital. If no capital is invested, there is no profitability to speak of.

The leverage effect is the difference between return on equity and return on capital employed. Although it can lift a company’s return on equity above return on capital employed, it can also depress it, turning the dream into a nightmare.

An efficient market is one in which the prices of financial securities at any time rapidly reflect all available relevant information. The terms “perfect market” or “market in equilibrium” are synonymous with “efficient market”.

To discount means to calculate the present value of a future cash flow.

The tools used for measuring creation of value can be classified under three headings:

- Economic tools: NPV, EVA and CFROI.

- Market tools: MVA and TSR.

- Accounting indicators: EPS, ROE, ROCE and Equity per share.

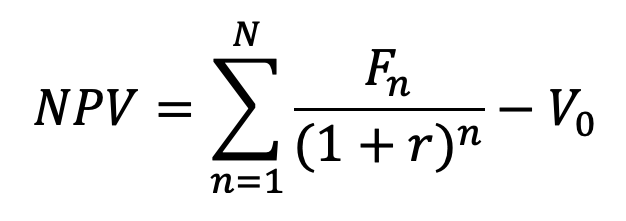

Net present value (NPV) is the difference between present value and market value (V0):

The discounting rate that makes net present value equal to zero is called the “internal rate of return (IRR)” or “yield to maturity”.

Risk is the probability that the outcome results in a loss. In a pure risk situation a gain never occurs; in a speculative risk situation a gain or a loss may occur.

There is a tradeoff between risk and return, low risks are associated with low potential returns, whereas high risks are associated with high potential returns.

Expected outcome E(r), is a measure of expected return, and standard deviation![]() (r) measures the average dispersion of returns around expected outcome, in other words, risk.

(r) measures the average dispersion of returns around expected outcome, in other words, risk.

Diversification means that investors do not concentrate their entire wealth in only one financial asset, because they prefer to hold well-diversified portfolios. This has the effect to reduce the risk of the investor’s portfolio.

The efficient frontier shows all the portfolios that offer investors the best risk-return ratio (i.e. minimal risk for a given return).

The capital market line links the market portfolio M to the risk-free asset. For a given level of risk, no portfolio is better than those located on this line.

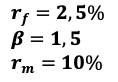

The CAPM is a financial model and it says that if all investors hold the market portfolio, the risk premium they will demand is proportional to market beta.

The beta measures a security’s sensitivity to market risk.

Example

Then, the required rate of return is:

![]()

The cost of capital is the minimum rate of return on the company’s investments that can satisfy both shareholders (the cost of equity) and debt holders (the cost of debt). The cost of capital is thus the company’s total cost of financing.

Share analysis is centered on changes in stock market prices, multiples (especially P/E), dividends and returns, compared with required returns.

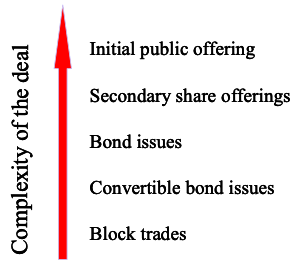

The company’s main goal in selling its securities to investors is to obtain the highest possible price.

For the sale to be successful, the company must offer investors a return or a potential capital gain. Otherwise, it will be harder to gain access to the market in the future.

Example: The type of offering:

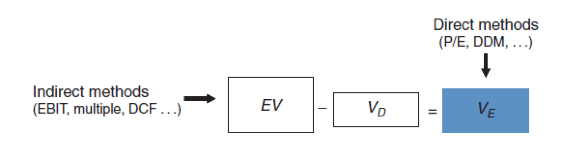

There are two methods used to value equity: the direct method and the indirect method. In the direct method, obviously, we value equity directly. In the indirect method, we first value the firm as a whole (what we call “enterprise” or “firm” Value), then subtract the value of net debt to get the equity value.

Example

The Discounted Cash Flow (DCF) method consists of applying the investment decision techniques to the firm value calculation, discounting a series of future cash flows.

The peer comparison or multiples approach is based on three fundamental principles:

– the company is to be valued in its entirety;

– the company is valued at a multiple of its profit-generating capacity. The most commonly used are the P/E ratio, EBITDA and EBIT multiples;

– markets are efficient and comparisons are therefore justified.

Example: Consider the following two similarly-sized companies, Ann and Valeria, operating in the same sector and enjoying the same outlook for the future, with the following characteristics:

|

Company |

Ann |

Valeria |

|

Operating income |

150 |

177 |

|

– Interest expense |

30 |

120 |

|

– Corporate income tax (40%) |

48 |

23 |

|

= Net Profit |

72 |

34 |

|

Market capitalization |

1800 |

? |

|

Value of debt (at 10% p. a.) |

300 |

1200 |

As Ann’s NOPAT is 150×( 1−40%)= 90, the multiple of Ann’s NOPAT is 2100/90 = 23.3. Valeria’s enterprise value is therefore equal to 23.3 times its NOPAT, or 23.3 × 106 = 2470. We now subtract the value of the debt (1200) to obtain the value of equity capital, or 1270.

Companies design their debt funding considering:

FUNDAMENTAL FACTORS

- taxes;

- financial distress;

- agency costs;

COSTS OF DEBT

- information asymmetries;

- disciplining role of debt;

- financial flexibility;

EXTENDED TRADEOFF MODEL

- capital structure of competitors;

- need to preserve an adequate rating;

- life cycle of the company.

Generally excess cash can be used for:

- Dividends;

- Share buybacks; and

- Capital reductions

A company may in certain circumstances buy back its own shares and either keep them on the balance sheet or cancel them, in which case there is said to be a capital decrease or capital reduction.

Dilution of control is the reduction of rights in the company sustained by a shareholder for which the capital increase entails neither an outflow nor an inflow of funds.

There are seven different type of shareholders:

- The family-owned company

- Business angels

- Private equity funds

- Institutional investors

- Financial holding companies

- Employee-shareholders

- Governments

A stock exchange listing offers distinct benefits: it enables financial managers to access capital markets and obtain the market value for their companies.

The control premium is the amount a buyer is ready to pay over the current market value in order to obtain the control of a company.

The minority discount is a reduction from the market value accepted by minority shareholders in order to sell their stocks.

Corporate governance is the organization of the control over and management of a firm. A narrower definition of corporate governance covers the relationship between the firm’s shareholders and management, mainly involving the functioning of the board of directors or the supervisory board.

For a private company the key is the art of negotiation that consists of allocating the value of the synergies expected from a merger or acquisition between the buyer and the seller.

For a public company the procedure is generally more complex. Stake-building can be the first step to acquiring control over a listed company. But it can be slow and faces the requirement of declaring the crossing of thresholds. A public offer is the usual way to acquire a listed company. It can be in cash or in shares, hostile or friendly, voluntary or mandatory.

Value is created only when the sum of cash flows from the two investments is higher because they are both managed by the same group. This is the result of industrial synergies (2 + 2 = 5), and not financial synergies, which do not exist.

A demerger is a separation of the activities of a group: the original shareholders become the shareholders of the separated companies.

In a splitoff, shareholders have the option to exchange their shares in the parent company for shares in a subsidiary.

A Leveraged Buyout (LBO) is the acquisition of a company by one or several private equity funds which finance their purchase mainly by debt.

There are five main categories of financial risk:

- Market risk

- Liquidity risk

- Counterparty or credit risk

- Operating risks

- Political, regulatory and legal risks