STOs and the business life cycle is an important consideration for startups exploring security token offerings as a capital raising solution. The standard model of a business life cycle progresses from the launch of a new venture through stages of growth, maturity, and eventual decline. Determining where security token offerings fit within this standard framework of a company’s progression from founding through proving and scaling its business model is crucial for startups.

Phase One: Launch

Each company begins its operations as a business and usually by launching new products or services.

During the launch phase, sales are low, but slowly (and hopefully steadily) increasing. Businesses focus on marketing to their target consumer segments by advertising their comparative advantages and value propositions.

However, as revenue is low and initial startup costs are high, businesses are prone to incur losses in this phase. In fact, throughout the entire business life cycle, the profit cycle lags behind the sales cycle and creates a time delay between sales growth and profit growth. This lag is important as it relates to the funding life cycle.

Finally, the cash flow during the launch phase is also negative but dips even lower than the profit.

This is due to the capitalization of initial startup costs that may not be reflected in the business’ profit but that are certainly reflected in its cash flow.

At launch, when sales are the lowest, business risk is the highest.

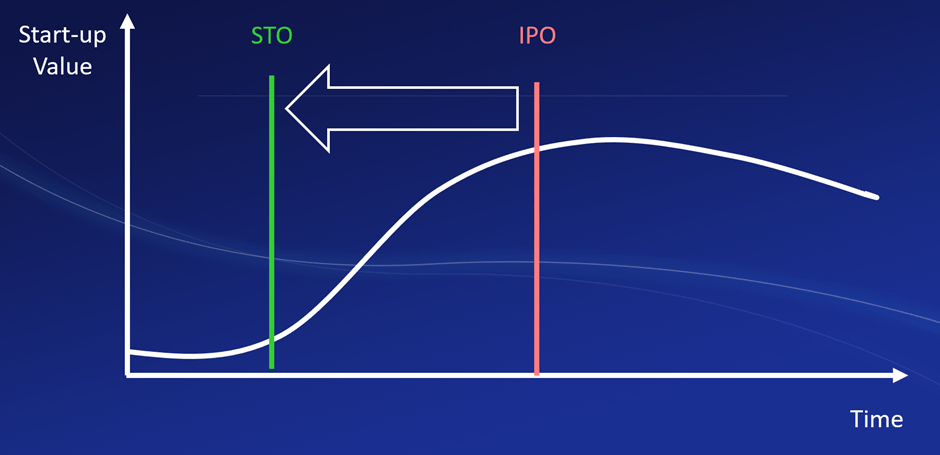

Startup companies face challenges raising funds during early phases. With unproven business models, obtaining debt is impossible due to repayment uncertainty. As sales start to gradually rise, so too does the ability to access external financing like institutional equity funds. Private investors emerge as potential options if the concept and model appeal to VCs, family offices or high net worth individuals. Short of an IPO, security token offerings provide private capital in a way that sets the stage for later public offerings. Careful planning readies companies for financing opportunities as their viability increases.

Phase Two: Growth

In the growth phase, companies experience rapid sales growth.

As sales increase rapidly, businesses start seeing profit once they pass the break-even point. However, as the profit cycle still lags behind the sales cycle, the profit level is not as high as sales.

Finally, the cash flow during the growth phase becomes positive, representing an excess cash inflow.

As companies experience booming sales growth, business risks decrease, while their ability to raise debt increases.

During the growth phase, companies start seeing a profit and positive cash flow, which evidences their ability to repay debt. The corporations’ products or services have been proven to provide value in the marketplace.

Companies at the growth stage seek more and more capital as they wish to expand their market reach and diversify their businesses. At this stage tapping external sources of finance is recommended to furnish growth phase with sufficient capital. STO is a cheaper option to legacy IPO and is recommended to companies that choose to address external sources earlier or are not scaled up enough to meet the requirements of legacy IPO. In this respect STO is a better value for money option as Andriotto Financial Services use cases demonstrate.

Phase Three: Shake-out

During the shake-out phase, sales continue to increase, but at a slower rate, usually due to either approaching market saturation or the entry of new competitors in the market.

Sales peak during the shake-out phase. Although sales continue to increase, profit starts to decrease in the shake-out phase. This growth in sales and decline in profit represents a significant increase in costs.

Lastly, cash flow increases and exceeds profit.

During the shake-out phase, sales peak.

The industry experiences steep growth, leading to fierce competition in the marketplace. However, as sales peak, the debt financing life cycle increases exponentially. Companies prove their successful positioning in the market, exhibiting their ability to repay debt. Business risk continues to decline. Whilst IPO is the dominant option making a company public by raising capital through an STO is still more efficient. Whilst security token markets are still not deep enough, they are global and the latter compensates the depth issue. As the tokenised securities is the future an STO will place a company directly into the eye of modern digital finance.

Phase Four: Maturity

When the business matures, sales begin to slowly decrease.

Profit margins get thinner, while cash flow stays relatively stagnant. As companies reach maturity, most major capital expenditures lie in the past. Thus cash generation exceeds reported profits.

Yet notably, many firms elongate this phase by reimagining themselves. They invest in novel technologies and rising markets, extending their cycles indefinitely. With foresight and flexibility, maturity provides opportunities to reinvent while capitalizing on experience. This allows for companies to reposition themselves in their dynamic industries, and hence refresh their growth in the marketplace.

As corporations approach maturity, sales start to decline.

Alas, unlike the earlier stages where the business risk cycle was inverse to the sales cycle, business risk moves in correlation with sales to the point where it carries no business risk. Due to the elimination of business risk, the most mature and stable businesses have the easiest access to debt capital. STO is available as an option but it is more likely that a company will use IPO as it will be after the large pools of capital available from pension funds. However as pension funds also move towards the digital arena, STO will also provide this opportunity.

Phase Five: Decline

In the final stage of the business life cycle, sales, profit, and cash flow all decline.

During this phase, companies accept their failure to extend their business life cycle by adapting to the changing business environment. Firms lose their competitive advantage and finally exit the market.

This decline in sales portrays the companies’ inability to adapt to changing business environments and extend their life cycles. STO techniques can be used to split, spin-off or segregate different prats of the business into new vehicles to better reflect their value.

Conclusion

An STO can bring the tapping of external sources of funds earlier in the lifecycle, thus providing early access to the opportunity, the capital markets and early liquidity in general. Whilst depth of token instruments markets is still not sufficient, they progress towards being a sufficient alternative liquidity source. Given the 5x lesser costs compared to IPO, STOs are worth considering. They are the preferred option for younger and smaller companies. STOs is the future of finance and the company will be better positioned for the future of funding and capital markets practices.

Based in Zug, the platform is fully compliant with all Swiss laws related to financial intermediaries, banking, anti-money laundering, and organized trading facilities. Among its core values, there are innovative solutions through blockchain technology, which ensures security and liquidity.

EDSX is the first platform in Europe with primary and secondary markets for both institutional and retails. EDSX is a pioneering platform that employs the world’s leading technology to globally list security tokens in both primary and secondary markets, listing digital securities of real financial instruments to the public with a decentralized peer-to-peer exchange. Our goal is to fully engage every aspect of the financial revolution.

Do you have a question for us?

Send your query here:

[email protected]